Revenue Recognition Contracts: Part 4

November 8, 2018

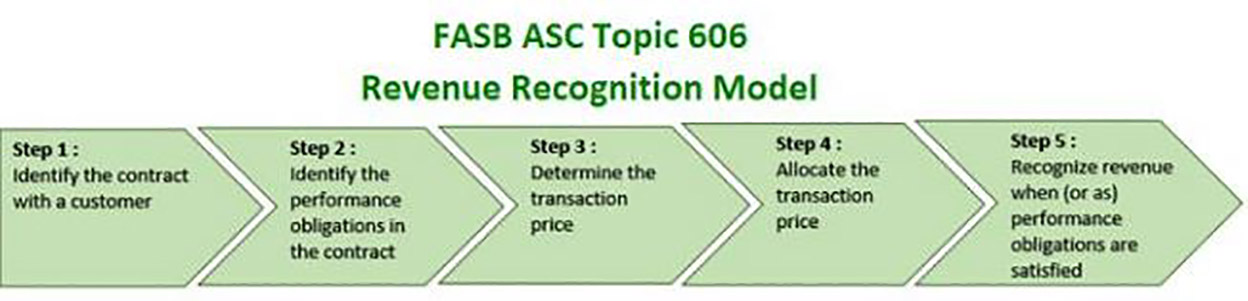

A continuation of our Revenue Recognition Contracts series, this final article addresses steps 4 and 5 of the new revenue recognition model: allocation of the transaction price to performance obligations and recognizing revenue when, or as, performance obligations are satisfied.

Step 4. Allocate the Transaction Price

Step 4. Allocate the Transaction Price

The fourth step of FASB Codification Topic 606 newly created revenue recognition model addresses allocating the transaction price (determined in step 3) to the separate performance obligations (determined in step 2). The intent in allocating the transaction price to the individual performance obligations is to assign each performance obligation an amount of consideration that the entity would expect to be entitled for fulfilling that portion of the contract.

In the simplest scenario where the contract only contains one performance obligation, the transaction price is entirely allocated to the identified performance obligation.

Standalone selling price

When a contract contains multiple performance obligations, additional considerations are necessary to determine a proper allocation of the transaction price to those performance obligations. Topic 606 requires the allocation be completed using the relative standalone selling prices for the performance obligations. Standalone selling prices are defined in the Codification as the “price that an entity would sell a good or service to a customer if the good or service was being sold on its own.”

In many instances, standalone selling prices are easily observable. However, when the standalone selling price is not directly observable, an entity will need to estimate it. Topic 606 permits any estimation method, as long as the method is reasonable and consistently applied, but also explicitly mentions three common methods that may be used:

- Adjusted market assessment approach – this approach considers market conditions by estimating what a customer in that market would be willing to pay for the goods and services. This approach would be easiest when an entity has experience selling within a market, and of course more complex when selling an entirely new good or service due to difficulty in anticipating market demand. The Codification also notes this approach might include referring to competitor pricing for similar goods and services and adjusting the estimate as appropriate.

- Expected cost plus a margin approach - in this estimation method, an entity would estimate the costs it expects to incur when completing a performance obligation and then add an appropriate margin.

- Residual approach – this method involves using the relative standalone selling price when observable for certain of the performance obligations, and assigning the residual of the total transaction price to the other performance obligations. This method is only permitted in two instances: a.) when there is a broad range of standalone selling prices because they are highly variable, or b.) the entity hasn’t established a price for a particular good or service. Therefore, it is expected the use of this method will not be as prevalent.

Discounts

If the sum of the standalone selling prices of the performance obligations in the contract exceeds the total contract transaction price, a discount is implicit in the contract. Under Topic 606, the Codification requires the discount be allocated proportionately to all of the individual performance obligations, unless an entity can justify that the discount is not related to certain of the performance obligations. In that instance, the entity may allocate the discount to only those goods or services to which it relates.

If the sum of the standalone selling prices of the performance obligations in the contract exceeds the total contract transaction price, a discount is implicit in the contract. Under Topic 606, the Codification requires the discount be allocated proportionately to all of the individual performance obligations, unless an entity can justify that the discount is not related to certain of the performance obligations. In that instance, the entity may allocate the discount to only those goods or services to which it relates.

Exhibit 1 – Allocating the transaction price to multiple performance obligations, with a discount:

XYZ Company enters into a contract with a customer to sell Widget A and B, along with providing Service C, for a total contract price of $350. The performance obligations associated with each widget and service will be satisfied at different points in time. XYZ Company regularly sells Widget A separately, for a standalone selling price of $150. Widget B and Service C do not have observable standalone selling prices. XYX Company estimates the standalone selling prices as the following:

|

Standalone

selling price

|

Method | |

| Widget A | $ 150 | Directly observable |

| Widget B | 75 | Adjusted market assessment approach |

| Service C | 225 | Expected cost plus a margin approach |

| $ 450 |

Because the total contract price ($350) is less than the sum of the standalone selling prices ($450), the customer received a discount for purchasing the bundled goods and services. Lacking evidence that the discount only relates to certain of the performance obligations, the discount is allocated proportionately amongst all of the performance obligations, as follows:

| Performance obligation |

Allocated transaction price |

Calculation |

| Widget A | $ 117 | ($150 / $450 x $350) |

| Widget B | 58 | ($75 / $450 x $350) |

| Service C | 175 | ($225 / $450 x $350) |

| $ 350 |

Other considerations

Because not all instances of allocating the transaction price to performance obligations are straight-forward, the Codification also provides guidance on how to address the following circumstances:

- Variable consideration – once variable consideration has been estimated in Step 3 of the revenue recognition model, an entity will need to consider under Step 4 whether variable consideration should be allocated to all of the performance obligations, or to one or more specific performance obligations. This differs from prior revenue recognition requirements because variable consideration was neither estimated or allocated to the transaction price, and therefore the new model results in earlier revenue recognition in many situations. Additional information on how to estimate the transaction price of variable consideration under step 3 is further addressed in Part III of our Revenue Recognition Contracts series.

- Changes in the transaction price – if the transaction price changes after the inception of the contract, an entity must allocate the difference in the old and new transaction price to the separate performance obligations. This must be done on the same basis that was used to initially allocate the transaction price. In some situations, certain of the performance obligations may have already been satisfied when the transaction price changes. If that is the case, the additional revenue from the change in transaction price should be recognized into revenue in the period that the transaction price changed.

Step 5. Recognize Revenue when (or as) Performance Obligations are Satisfied

Under the new revenue recognition model, an entity will recognize revenue under Step 5 only upon completion of a performance obligation as identified in the contract. The key to determining when a performance obligation has been satisfied is whether or not the customer has obtained control of the promised good or service. In addition, to allow for proper revenue recognition, consideration needs to be made on whether control was transferred as of a point in time, or over time.

Over time

As provided by Topic 606, the following criteria give rise to recognition over time, if any of the following are met:

- The customer simultaneously receives and consumes the benefits provided by the entity’s performance as the entity performs (for example, most routine or recurring service contracts)

- The entity’s performance creates/enhances an asset that the customer controls as the asset is created/enhanced (for example, building an asset on a customer’s site)

- The entity’s performance does not create an asset with an alternative use to the entity, and the entity has an enforceable right to payment for performance completed to date (for example, building a specialized asset only the customer can use)

If it is determined revenue should be recognized over time, it is necessary to identify how to measure the progress towards fulfilling the performance obligation. Estimation methods utilizing either output or input criteria are acceptable, but the chosen method should appropriately depict the transfer of control of the good or service to the customer. Examples of some commonly used output methods include units produced or milestones reached, while examples of input methods may include costs incurred or labor hours.

Exhibit 2 – Recognition of revenue over time

ABC Company enters into a contract with a customer to build specialized equipment for $100,000. ABC Company has no alternative use for the specialized equipment. In addition, per the contract provisions, the customer may take immediate ownership of the work-in-process in the event the contract is cancelled.

ABC Company would recognize revenue associated with this contract over time (as the equipment is being constructed). This contract meets two criteria for recognition in this manner: a.) the customer controls the asset as it is created and b.) the equipment has no alternative use to ABC Company. Because recognition will occur over time, ABC Company must select a method to measure progress. In this instance, an input method based on actual costs incurred in relation to total estimated costs would be an appropriate manner to estimate progress. The resulting allocation ratio would be applied to the total contract price of $100,000 to calculate the amount of revenue to be recognized each period until the contract is completed.

At a point in time

If an entity cannot demonstrate one of the above criteria have been met for recognition over time, they need to determine the proper point in time to recognize revenue, when control has been transferred to the customer. As described in the Codification, the following are indicators that control has transferred:

- The entity has a present right to payment for the asset

- The customer has legal title to the asset

- Physical possession of the asset has transferred to the customer

- The customer has the significant risks and rewards of ownership of the asset

- The customer has accepted the asset

Contracts that were recognized as of a point in time under prior guidance may now require recognition over time, resulting in earlier revenue recognition in many cases.

Other considerations

The standard includes guidance addressing revenue recognition matters associated with:

- Repurchase agreements

- Bill-and-hold arrangements

- Consignment arrangements

- Warranties

- Licenses of intellectual property and royalties

- Principal vs. agent reporting

While the effective date for the new revenue recognition standard becomes effective for non-public entities for years beginning after December 15, 2018 (i.e. 2019 calendar year), it is not too early to begin preparing for proper implementation.